We can now offer a simple leasing finance option

If you're a registered business and looking to spread the cost of your purchase then we can offer a simple leasing finance option for orders over £1,000.

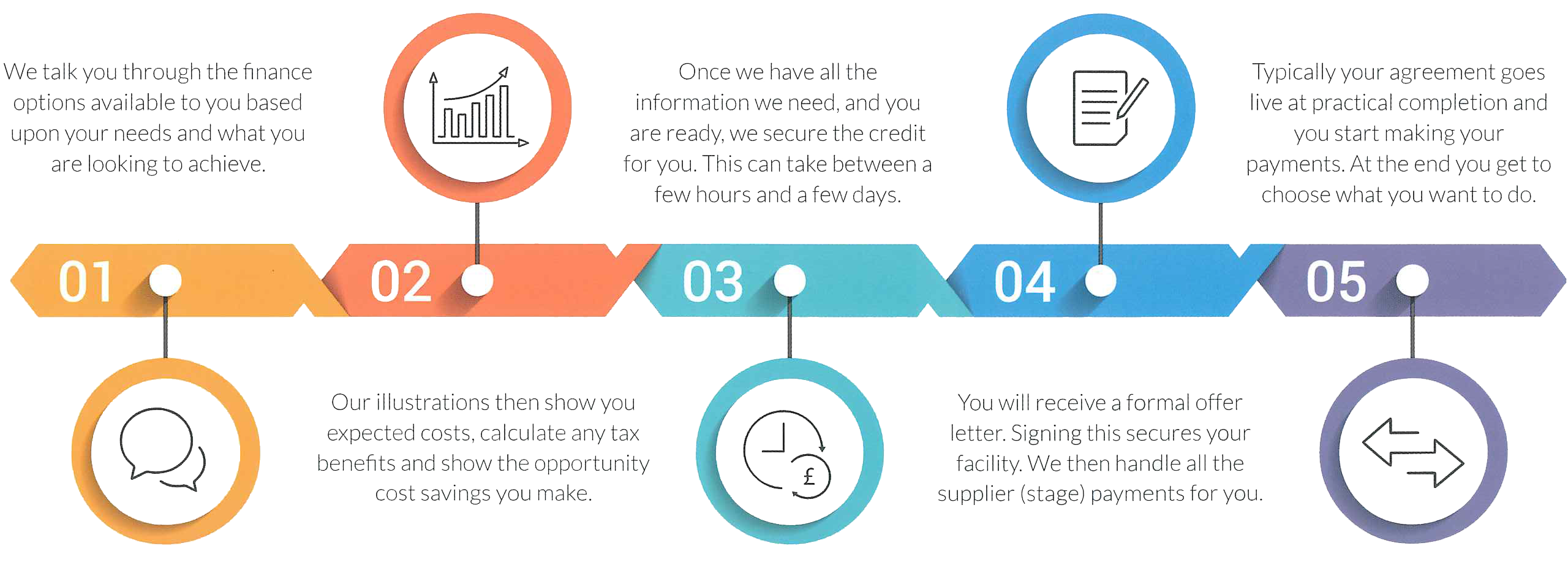

How does it work?

A subscription payment plan can offer you a number of benefits including:

- Significant tax benefits for private organisations, payments are fully tax-deductible unlike using cash

- Low, fixed payments allow easy budgeting throughout the term

- Spread the cost of your purchases in line with the return on the investment

- Make your capital work for you, rather than sink valuable cash into depreciating assets, deploy it elsewhere for higher returns

- Totally flexible, a subscription payment plan allows you to determine the term, how frequently you pay and can be upgraded or changed throughout

- Manage obsolescence and refresh assets strategically rather than face unbudgeted large write-offs

- Make investment decisions based upon your needs and not limited by constrained budgets

- Reduce dependency on your primary funder(s). Your existing credit lines remain unaffected and you will have access to over 40 specialist asset funders

- Spread the cost of the VAT which is paid in installments rather than as a lump sum up-front

- Build all your costs into the subscription payment plan to maximise your benefits even further

Instant Lease Quotation

To obtain an instant lease quotation, please use our lease calculator below by selecting your business type and moving the two sliders to reflect your needs. For projects over £100,000, or for a more accurate, bespoke quotation contact us to find out more.

Business Type

Public Sector/Corporate organisations should get in touch to learn about our preferential rates and operating lease options not available here.